Exhibit 3(i)

| |

Delaware

|

PAGE 1

|

| |

The First State

|

|

I, JEFFREY W. BULLOCK, SECRETARY OF STATE OF THE STATE OF DELAWARE, DO HEREBY CERTIFY THAT “PERMA-FIX ENVIRONMENTAL SERVICES, INC.” IS DULY INCORPORATED UNDER THE LAWS OF THE STATE OF DELAWARE AND IS IN GOOD STANDING AND HAS A LEGAL CORPORATE EXISTENCE NOT HAVING BEEN CANCELLED OR DISSOLVED SO FAR AS THE RECORDS OF THIS OFFICE SHOW AND IS DULY AUTHORIZED TO TRANSACT BUSINESS.

THE FOLLOWING DOCUMENTS HAVE BEEN FILED:

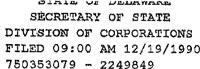

CERTIFICATE OF INCORPORATION, FILED THE NINETEENTH DAY OF DECEMBER, A.D. 1990, AT 9 O'CLOCK A.M.

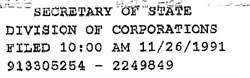

RESTATED CERTIFICATE, FILED THE TWENTY–SIXTH DAY OF NOVEMBER, A.D. 1991, AT 10 O'CLOCK A.M.

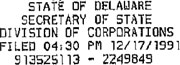

CERTIFICATE OF AMENDMENT, CHANGING ITS NAME FROM “NATIONAL ENVIRONMENTAL INDUSTRIES, LTD.” TO “PERMA-FIX ENVIRONMENTAL SERVICES, INC.”, FILED THE SEVENTEENTH DAY OF DECEMBER, A.D. 1991, AT 4:30 O'CLOCK P.M.

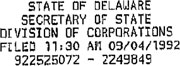

CERTIFICATE OF AMENDMENT, FILED THE FOURTH DAY OF SEPTEMBER, A.D. 1992, AT 11:30 O'CLOCK A.M.

CERTIFICATE OF DESIGNATION, FILED THE SIXTH DAY OF FEBRUARY, A.D. 1996, AT 4 O'CLOCK P.M.

| |

|

|

|

|

|

| |

|

|

|

| |

|

Jeffrey W. Bullock, Secretary of State

|

| |

2249849 8310

|

|

AUTHENTICATION:

|

7162972

|

| |

|

|

|

| |

090228186 |

|

DATE:

|

03-03-09

|

|

You may verify this certificate online

at corp.delaware.gov/authver.shtml

|

|

|

|

|

| |

Delaware

|

PAGE 2

|

| |

The First State

|

|

CERTIFICATE OF DESIGNATION, FILED THE TWENTIETH DAY OF FEBRUARY, A.D. 1996, AT 10:45 O'CLOCK A.M.

CERTIFICATE OF DESIGNATION, FILED THE NINETEENTH DAY OF JULY, A.D. 1996, AT 12:30 O'CLOCK P.M.

CERTIFICATE OF DESIGNATION, FILED THE SIXTEENTH DAY OF DECEMBER, A.D. 1996, AT 4:30 O'CLOCK P.M.

CERTIFICATE OF AMENDMENT, FILED THE SIXTH DAY OF JANUARY, A.D. 1997, AT 4:30 O'CLOCK P.M.

CERTIFICATE OF DESIGNATION, FILED THE ELEVENTH DAY OF JUNE, A.D. 1997, AT 11 O'CLOCK A.M.

CERTIFICATE OF DESIGNATION, FILED THE FOURTEENTH DAY OF JULY, A.D. 1997, AT 11:15 O'CLOCK A.M.

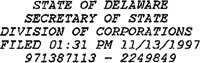

CERTIFICATE OF DESIGNATION, FILED THE THIRTEENTH DAY OF NOVEMBER, A.D. 1997, AT 1:30 O'CLOCK P.M.

CERTIFICATE OF DESIGNATION, FILED THE THIRTEENTH DAY OF NOVEMBER, A.D. 1997, AT 1:31 O'CLOCK P.M.

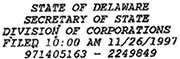

CERTIFICATE OF DESIGNATION, FILED THE TWENTY-SIXTH DAY OF NOVEMBER, A.D. 1997, AT 10 O'CLOCK A.M.

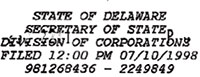

CERTIFICATE OF DESIGNATION, FILED THE TENTH DAY OF JULY, A.D. 1998, AT 12 O'CLOCK P.M.

| |

|

|

|

|

|

| |

|

|

|

| |

|

Jeffrey W. Bullock, Secretary of State

|

| |

2249849 8310

|

|

AUTHENTICATION:

|

7162972

|

| |

|

|

|

| |

090228186 |

|

DATE:

|

03-03-09

|

|

You may verify this certificate online

at corp.delaware.gov/authver.shtml

|

|

|

|

| |

Delaware

|

PAGE 3

|

| |

The First State

|

|

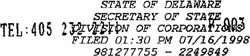

CERTIFICATE OF DESIGNATION, FILED THE SIXTEENTH DAY OF JULY, A.D. 1998, AT 1:30 O’CLOCK P.M.

CERTIFICATE OF DESIGNATION, FILED THE SIXTEENTH DAY OF JULY, A.D. 1998, AT 1:31 O’CLOCK P.M.

CERTIFICATE OF DESIGNATION, FILED THE SIXTEENTH DAY OF JULY, A.D. 1998, AT 1:32 O’CLOCK P.M.

CERTIFICATE OF DESIGNATION, FILED THE FIFTEENTH DAY OF JULY, A.D. 1999, AT 12:30 O’CLOCK P.M.

CERTIFICATE OF DESIGNATION, FILED THE FIFTEENTH DAY OF JULY, A.D. 1999, AT 12:31 O’CLOCK P.M.

CERTIFICATE OF DESIGNATION, FILED THE FIFTEENTH DAY OF JULY, A.D. 1999, AT 12:32 O’CLOCK P.M.

CERTIFICATE OF DESIGNATION, FILED THE FIFTEENTH DAY OF JULY, A.D. 1999, AT 12:33 O’CLOCK P.M.

CERTIFICATE OF DESIGNATION, FILED THE TENTH DAY OF AUGUST, A.D. 1999, AT 12:30 O’CLOCK P.M.

CERTIFICATE OF DESIGNATION, FILED THE TENTH DAY OF AUGUST, A.D. 1999, AT 12:31 O’CLOCK P.M.

CERTIFICATE OF DESIGNATION, FILED THE TENTH DAY OF AUGUST, A.D. 1999, AT 12:32 O’CLOCK P.M.

| |

|

|

|

|

|

| |

|

|

|

| |

|

Jeffrey W. Bullock, Secretary of State

|

| |

2249849 8310

|

|

AUTHENTICATION:

|

7162972

|

| |

|

|

|

| |

090228186 |

|

DATE:

|

03-03-09

|

|

You may verify this certificate online

at corp.delaware.gov/authver.shtml

|

|

|

|

| |

Delaware

|

PAGE 4

|

| |

The First State

|

|

CERTIFICATE OF DESIGNATION, FILED THE TENTH DAY OF AUGUST, A.D. 1999, AT 12:33 O’CLOCK P.M.

CERTIFICATE OF DESIGNATION, FILED THE FOURTEENTH DAY OF JUNE, A.D. 2001, AT 10 O’CLOCK A.M.

CERTIFICATE OF DESIGNATION, FILED THE FOURTEENTH DAY OF JUNE, A.D. 2001, AT 10:01 O’CLOCK A.M.

CERTIFICATE OF AMENDMENT, FILED THE TWENTIETH DAY OF JUNE, A.D. 2002, AT 10 O’CLOCK A.M.

CERTIFICATE OF DESIGNATION, FILED THE SIXTH DAY OF MAY, A.D. 2008, AT 6:44 O’CLOCK P.M.

AND I DO HEREBY FURTHER CERTIFY THAT THE AFORESAID CERTIFICATES ARE THE ONLY CERTIFICATES ON RECORD OF THE AFORESAID CORPORATION, “PERMA-FIX ENVIRONMENTAL SERVICES, INC.”.

AND I DO HEREBY FURTHER CERTIFY THAT THE ANNUAL REPORTS HAVE BEEN FILED TO DATE.

AND I DO HEREBY FURTHER CERTIFY THAT THE FRANCHISE TAXES HAVE BEEN PAID TO DATE.

| |

|

|

|

|

|

| |

|

|

|

| |

|

Jeffrey W. Bullock, Secretary of State

|

| |

2249849 8310

|

|

AUTHENTICATION:

|

7162972

|

| |

|

|

|

| |

090228186 |

|

DATE:

|

03-03-09

|

|

You may verify this certificate online

at corp.delaware.gov/authver.shtml

|

|

|

|

CERTIFICATE OF INCORPORATION

OF

NATIONAL ENVIRONMENTAL INDUSTRIES, LTD.

I, the undersigned, in order to form a corporation for the purposes hereinafter stated, under and pursuant to the provisions of the General Corporation Law of the State of Delaware, do hereby certify as follows:

FIRST: The name of the corporation is National Environmental Industries, Ltd. (hereinafter referred to as the “Corporation”).

SECOND: The registered office of the Corporation is to be located at 32 Loockerman Square, Suite L–100, City of Dover, County of Kent, State of Delaware 19901. The name of its registered agent at that address is The Prentice–Hall Corporation System, Inc.

THIRD: The purpose of the Corporation is to engage in any lawful act or activity for which a corporation may be organized under the General Corporation Law of the State of Delaware.

FOURTH: (1) The Corporation shall be authorized to issue 3,000 shares, all of which shall have no par value, all of which shall be of the same class and all of which are to be designated “Common Stock”.

(2) Except as otherwise required by statute, the holders of the Common Stock of the Corporation shall possess the exclusive right to vote for the election of directors and for all other corporate purposes.

(3) Except as otherwise required by statute, the designations, and the powers, preferences and rights, and the qualifications or restrictions thereof, of any class or classes of stock or any series of any class of stock of the Corporation may be determined from time to time by resolution or resolutions of the Board of Directors.

FIFTH: The name and address of the incorporator are as follows:

| |

|

|

|

|

Name

|

|

|

Address

|

| |

|

|

|

|

Robert Scarboro

|

|

c/o

|

Phillips, Nizer, Benjamin, |

| |

|

|

Krim & Ballon

|

| |

|

|

40 West 57th Street

|

| |

|

|

New York, New York 10019

|

SIXTH: The following provisions are inserted for the management of the business and for the conduct of the affairs of the Corporation, and for further definition, limitation and regulation of the powers of the Corporation and of its directors and stockholders:

8082N

(1) The number of directors of the Corporation shall be such as from time to time shall be fixed by, or in the manner provided in, the by-laws of the Corporation. Election of directors need not be by ballot unless the by-laws of the Corporation so provide.

(2) In furtherance and not in limitation of the powers conferred by the laws of the State of Delaware, the Board of Directors shall have power without the assent or vote of the stockholders:

(a) To make, alter, amend, change, add to or repeal the by-laws of the Corporation in any manner not inconsistent with the laws of the State of Delaware or this Certificate of Incorporation, subject to the power of the stockholders of the Corporation having voting power to alter, amend or repeal the by-laws made by the Board of Directors of the Corporation; to fix and vary the amount to be reserved for any proper purpose; to authorize and cause to be executed mortgages and liens upon all or any part of the property of the Corporation, to determine the use and disposition of any surplus or net profits; and to fix the times for the declaration and payment of dividends; and

(b) To determine from time to time whether, and to what extent, and at what times and places, and under what conditions the accounts and books of the Corporation (other than the stock ledger), or any of them, shall be open to the inspection of the stockholders.

(3) In addition to the powers and authorities hereinbefore or by statute expressly conferred upon it, the Board of Directors of the Corporation is hereby empowered to exercise all such powers and do such acts and things as may be exercised or done by the Corporation; subject, nevertheless, to the provisions of the laws of the State of Delaware, of this Certificate of Incorporation, and to the by-laws of the Corporation in effect from time to time.

SEVENTH: The corporation may, to the full extent permitted by Section 145 of the General Corporation Law of the State of Delaware, as amended from time to time, indemnify all persons whom it may indemnify pursuant thereto.

EIGHTH: Whenever a compromise or arrangement is proposed between the Corporation and its creditors or any class of them and/or between the Corporation and its stockholders or any class of them, any court of equitable jurisdiction within the State of Delaware, may, on the application in a summary way of the Corporation or of any creditor or stockholder thereof or on the application of any receiver or receivers appointed for the Corporation under the provisions of Section 291 of Title 8 of the Delaware Code or on the application of trustees in dissolution or of any receiver or receivers appointed for the Corporation under the provisions of Section 279 of Title 8 of the Delaware Code, order a meeting of the creditors or class of creditors, and/or of the stockholders or class of stockholders of the Corporation, as the case may be, to be summoned in such manner as the said court directs. If a majority in number representing three-fourths (3/4) in value of the creditors or class of creditors, and/or of the stockholders or class of stockholders of the Corporation, as the case may be, agree to any compromise or arrangement and to any reorganization of the Corporation as consequence of such compromise or arrangement, the said compromise or arrangement and the said reorganisation shall, if sanctioned by the court to which the said application has been made, be binding on all the creditors or class of creditors, and/or on all the stockholders or class of stockholders, of the Corporation, as the case may be, and also on the Corporation.

8082N

NINTH: The Corporation reserves the right to amend, alter, change or repeal any provision contained in this Certificate of Incorporation in the manner now or hereafter prescribed by law, and all rights and powers conferred herein on stockholders, directors and officers are subject to this reserved power.

IN WITNESS WHEREOF, I, Robert Scarboro, the sole incorporator of National Environmental Industries, Ltd., have hereunto signed my name and affirm that the statements made herein are true under the penalties of perjury, this 17th day of December, 1990.

| |

|

| |

Robert Scarboro

|

| |

c/o Phillips, Nizer, Benjamin,

|

| |

Krim & Ballon

|

| |

40 West 57th Street

|

| |

New York, New York 10019

|

8082N

RESTATED CERTIFICATE OF INCORPORATION

OF

NATIONAL ENVIRONMENTAL INDUSTRIES, LTD.

1. The present name of the corporation (hereinafter called the “Corporation”) is National Environmental Industries, Ltd., and the date of filing the original certificate of incorporation of the Corporation with the Secretary of State of the State of Delaware is December 19, 1990.

2. The certificate of incorporation of the corporation is hereby amended by striking out Articles FOURTH through NINTH thereof and by substituting in lieu thereof new Articles FOURTH through NINTH as set forth in the Restated Certificate of Incorporation hereinafter provided for.

3. The provisions of the certificate of incorporation as heretofore amended and/or supplemented, and as herein amended, are hereby restated and integrated into the single instrument which is hereinafter set forth, and which is entitled Restated Certificate of Incorporation of National Environmental Industries, Ltd. without any further amendment other than the amendment certified herein and without any discrepancy between the provisions of the certificate of incorporation as heretofore amended and supplemented and the provisions of the said single instrument hereinafter set forth.

4. The amendment and restatement of the certificate of incorporation herein certified have been duly adopted by the stockholders in accordance with the provisions of Sections 228, 242 and 245 of the General Corporation Law of the State of Delaware. Prompt written notice of the adoption of the amendment and of the restatement of the certificate of incorporation herein certified has been given to those stockholders who have not consented in writing thereto, as provided in Section 228 of the General Corporation Law of the State of Delaware.

5. The certificate of incorporation of the Corporation, as amended and restated herein, shall at the effective time of this Restated Certificate of Incorporation, read as follows:

“Restated Certificate of Incorporation

of

National Environmental Industries, Ltd.

FIRST: The name of the Corporation is National

Environmental Industries, Ltd.

SECOND: The address of the Corporation’s registered office in the State of Delaware is 32 Loockerman Square, Suite L-100, City of Dover, County of Dover. The name of its registered agent at such address is The Prentice-Hall Corporation System, Inc.

THIRD: The purpose of the Corporation is to engage in any lawful act or activity for which a corporation may be organized under the laws of the General Corporation Law of the State of Delaware.

FOURTH: The total number of shares of capital stock which the Corporation shall have authority to issue is Twenty-Two Million (22,000,000) shares, of which Twenty Million (20,000,000) shares shall be Common Stock, par value $.001 per share, and Two Million (2,000,000) shares shall be Preferred, Stock, $.001 par value per share.

The Preferred Stock may be issued from time to time in one or more series. The Board of Directors is hereby expressly authorized to provide, by resolution or resolutions duly adopted by it prior to issuance, for the creation of each such series and to fix the designation and the powers, preferences, rights, qualifications, limitations and restrictions relating to the shares of each such series. The authority of the Board of Directors with respect to each such series of Preferred Stock shall include, but not be limited to, determining the following:

(a) the designation of such series, the number of shares to constitute such series and the stated value if different from the par value thereof;

(b) whether the shares of such series shall have voting rights, in addition to any voting rights provided by law, and, if so, the terms of such voting rights, which may be general or limited;

(c) the dividends, if any, payable on such series, whether any such dividends shall be cumulative, and, if so, from what dates, the conditions and dates upon which such dividends shall be payable, and the preference or relation which such dividends shall bear to the dividends payable on any shares of stock of any other class or any other series of Preferred Stock;

(d) whether the shares of such series shall be subject to redemption by the Corporation, and, if so, the times, prices and other conditions of such redemption;

(e) the amount or amounts payable upon shares of such series upon, and the rights of the holders of such series in, the voluntary or involuntary liquidation, dissolution or winding up, or upon any distribution of the assets, of the Corporation;

(f) whether the shares of such series shall be subject to the operation of a retirement or sinking fund and, if so, the extent to and manner in which any such retirement or sinking fund shall be applied to the purchase or redemption of the shares of such series for retirement or other corporate purposes and the terms and provisions relating to the operation thereof;

(g) whether the shares of such series shall be convertible into, or exchangeable for, shares of stock of any other class or any other series of Preferred Stock or any other securities and, if so, the price or prices or the rate or rates of conversion or exchange and the method, if any, of adjusting the same, and any other terms and conditions of conversion or exchange;

(h) the limitations and restrictions, if any, to be effective while any shares of such series are outstanding upon the payment of dividends or the making of other distributions on, and upon the purchase, redemption or other acquisition by the Corporation of, the Common Stock or shares of stock of any other class or any other series of Preferred Stock;

(i) the conditions or restrictions, if any, upon the creation of indebtedness of the Corporation or upon the issue of any additional stock, including additional shares of such series or of any other series of Preferred Stock or of any other class; and

(j) any other powers, preferences and relative, participating, optional and other special rights, and any qualifications, limitations and restrictions, thereof.

The powers, preferences and relative, participating, optional and other special rights of each series of Preferred Stock, and the qualifications, limitations or restrictions thereof, if any, may differ from those of any and all other series at any time outstanding. All shares of any one series of Preferred Stock shall be identical in all respects with all other shares of such series, except that shares of any one series issued at different times may differ as to the dates from which dividends thereof shall be cumulative.

FIFTH: Unless required by law or determined by the chairman of the meeting to be advisable, the vote by stockholders on any matter, including the election of directors, need not be by written ballot.

SIXTH: The Corporation reserves the right to increase or decrease its authorized capital stock, or any class or series thereof, and to reclassify the same, and to amend, alter, change or repeal any provision contained in the Certificate of Incorporation under which the Corporation is organized or in any amendment thereto, in the manner now or hereafter prescribed by law, and all rights conferred upon stockholders in said Certificate of Incorporation or any amendment thereto are granted subject to the aforementioned reservation.

SEVENTH: The Board of Directors shall have the power at any time, and from time to time, to adopt, amend and repeal any and all By-Laws of the Corporation.

EIGHTH: All persons who the Corporation is empowered to indemnify pursuant to the provisions of Section 145 of the General Corporation Law of the State of Delaware (or any similar provision or provisions of applicable law at the time in effect), shall be indemnified by the Corporation to the full extent permitted thereby. The foregoing right of indemnification shall not be deemed to be exclusive of any other rights to which those seeking indemnification may be entitled under any by-law, agreement, vote of stockholders or disinterested directors, or otherwise. No repeal or amendment of this Article EIGHTH shall adversely affect any rights of any person pursuant to this Article EIGHTH which existed at the time of such repeal or amendment with respect to acts or omissions occurring prior to such repeal or amendment.

NINTH: No director of the Corporation shall be personally liable to the Corporation or its stockholders for any monetary damages for breaches of fiduciary duty as a director, provided that this provision shall not eliminate or limit the liability of a director (i) for any breach of the director’s duty of loyalty to the Corporation or its stockholders; (ii) for acts or omissions not in good faith or which involve intentional misconduct or a knowing violation of law; (iii) under Section 174 of the General Corporation Law of the State of Delaware; or (iv) for any transaction from which the director derived an improper personal benefit. No repeal or amendment of this Article NINTH shall adversely affect any rights of any person pursuant to this Article NINTH which existed at the time of such repeal or amendment with respect to acts or omissions occurring prior to such repeal or amendment.”

IN WITNESS WHEREOF, we have signed this Certificate this 22 day of November, 1991.

| |

|

|

| |

President |

|

ATTEST:

|

|

| Secretary |

|

CERTIFICATED OF AMENDMENT

TO THE

RESTATED CERTIFICATE OF INCORPORATION

OF

NATIONAL ENVIRONMENTAL INDUSTRIES, LTD.

It is hereby certified that:

1. The name of the corporation (hereinafter called the “Corporation”) is National Environmental Industries, Ltd.

2. The Restated Certificate of Incorporation of the Corporation is hereby amended by striking out Article FIRST thereof and by substituting in lieu of said Article FIRST the following new Article.

“FIRST: The name of the Corporation is Perma-Fix Environmental services, Inc.”

3. The amendment of the Certificate of Incorporation herein certified has been daily adopted in accordance with the provisions of Sections 228 and 242 of the General Corporation Law of the State of Delaware. Prompt written notice of the adoption of the amendment herein certified has been given to these Stockholders who have not consented in writing thereto, as provided in Section 228 of the General Corporation Law of the State of Delaware.

IN WITNESS WHEREOF, we have signed this Certificate this 16th day of December, 1991.

| |

|

|

| |

Louis Centofanti, President |

|

| Attest: |

|

|

|

| Mark Zwecker, Secretary |

|

CERTIFICATE OF AMENDMENT

TO

RESTATED CERTIFICATE OF INCORPORATION, AS AMENDED

OF

PERMA-FIX ENVIRONMENTAL SERVICES, INC.

Perma-Fix Environmental Services, Inc., a Delaware corporation (the “Corporation”), does hereby certify:

That the amendment set forth below to the Corporation’s Restated Certificate of Incorporation, as amended was duly adopted in accordance with the provisions of Section 242 of the General Corporation Law of the State of Delaware and written notice thereof has been given as provided in Section 228 thereof:

I) The first paragraph of Article FOURTH of the Corporation’s Restated Certificate of Incorporation, as amended is hereby deleted and replaced in its entirety by the following:

Fourth: The total number of shares of capital stock that the Corporation shall have authority to issue is 22,000,000, shares of which 20,000,000 shares of the par value of $.001 per share shall be designated Common Stock (“Common Stock”), and 2,000,000 shares of the par value of $.001 per share shall be designated Preferred Stock.

As of September 4, 1992 (the “Effective Time”), each share of Common Stock issued and outstanding immediately prior to the Effective Time shall automatically be changed and converted, without any action on the part of the holder thereof, into 1/3.0236956 of a share of Common Stock and, in connection with fractional interests in shares of Common Stock of the Corporation, each holder whose aggregate holdings of shares of Common Stock prior to the Effective Time amounted to less than 3.0236955, or to a number not evenly divisible by 3.0236956 shares of Common Stock shall be entitled to receive for such fractional interest, and at such time, any such fractional interest in shares of Common Stock of the Corporation shall be converted into the right to receive, upon surrender of the stock certificates formerly representing shares of Common Stock of the Corporation, one whole share of Common Stock.

IN WITNESS whereof, Perma-Fix Environmental Services, Inc. has caused this Certificate to be signed and attested to by its duly authorized officers as of this first day of September, 1992.

| |

Perma-Fix Environmental Services, Inc.

|

|

| |

|

|

|

|

|

By:

|

|

|

| |

|

Dr. Louis Centofanti

President

|

|

| |

|

|

|

ATTEST:

| By : |

|

|

| |

Secretary |

|

CERTIFICATE OF DESIGNATIONS

OF SERIES I CLASS A PREFERRED STOCK

OF

PERMA-FIX ENVIRONMENTAL SERVICES, INC.

Perma-Fix Environmental Services, Inc. (the “Corporation”), a corporation organized and existing under the General Corporation Law of the State of Delaware, does hereby certify:

That, pursuant to authority conferred upon by the Board of Directors by the Corporation’s Certificate of Incorporation, as amended, and pursuant to the provisions of Section 151 of the Delaware Corporation Law, said Board of Directors, acting by unanimous written consent in lieu of a meeting dated February 2, 1996, hereby adopted the terms of the Series I Class A Preferred Stock, which resolutions are set forth on the attached page.

| Dated: February 2, 1996 |

PERMA-FIX ENVIRONMENTAL SERVICES, INC.

|

|

| |

|

|

|

|

|

By:

|

|

|

| |

|

Dr. Louis P. Centofanti

Chairman of the Board

|

|

| |

|

|

|

| |

|

|

|

ATTEST:

|

|

| Mark A. Zwecker, Secretary |

|

PAGE 03

PERMA-FIX ENVIRONMENTAL SERVICES, INC.

(the “Corporation”)

RESOLUTION OF THE BOARD OF DIRECTORS

FIXING THE NUMBER AND DESIGNATING THE RIGHTS, PRIVILEGES,

RESTRICTIONS AND CONDITIONS ATTACHING TO THE SERIES I CLASS A

PREFERRED STOCK

WHEREAS,

|

A.

|

The Corporation’s share capital includes Preferred Stock, par value $.001 per share (“Preferred Stock”), which Preferred Stock may be issued in one or more series with the directors of the Corporation (the “Board”) being entitled by resolution to fix the number of shares in each series and to designate the rights, designations, preferences, and relative, participating, optional or other special rights, privileges, restrictions and conditions attaching to the shares of each such series; and

|

|

B.

|

It is in the best interests of the Corporation for the Board to create a new series from the Preferred Stock designated as the Series I Class A Preferred Stock, par value $.001.

|

NOW, THEREFORE, BE IT RESOLVED, THAT:

The Series I Class A Preferred Stock, par value $.001 (the “Series I Class A Preferred Stock”) of the Corporation shall consist of 1,100 shares and no more and shall be designated as the Series I Class A Preferred Stock and in addition to the preferences, rights, privileges, restrictions and conditions attaching to all the Series I Class A Preferred Stock as a series, the rights, privileges, restrictions and conditions attaching to the Series I Class A Preferred Stock shall be as follows:

Part 1 - Voting and Preemptive Rights.

1.1 Except as otherwise provided herein, in the Certificate of Incorporation (the “Articles”) or the General Corporation Law of the State of Delaware (the “GCL”), each holder of Series I Class A Preferred Stock, by virtue of his ownership thereof, shall be entitled to cast that number of votes per share thereof on each matter submitted to the Corporation’s shareholders for voting which equals the number of votes which could be cast by such holder of the number of shares of the Corporation’s Common Stock, par value $.001 per share (the “Common Shares”) into which such shares of Series I Class A Preferred Stock would be converted into pursuant to Part 5 hereof immediately prior to the record date of such vote. The outstanding Series I Class A Preferred Stock and the Common Shares of the Corporation shall vote together as a single class, except as otherwise expressly required by the GCL or Part 7 hereof. The Series I Class A Preferred Stock shall not have cumulative voting rights.

1.2 The Series I Class A Preferred Stock shall not give its holders any preemptive rights to acquire any other securities issued by the Corporation at any time in the future.

Part 2 - Liquidation Rights.

2.1 If the Corporation shall be voluntarily or involuntarily liquidated, dissolved or wound up at any time when any Series I Class A Preferred Stock shall be outstanding, the holders of the then outstanding Series I Class A Preferred Stock shall have a preference in distribution of the Corporation’s property available for distribution to the holders of the Common Shares equal to $1,000 consideration per outstanding share of Series I Class A Preferred Stock, together with an amount equal to all unpaid dividends accrued thereon, if any, to the date of payment of such distribution, whether or not declared by the Board: provided, however, that the merger of the Corporation with any corporation or corporations in which the Corporation is not the survivor, or the sale or transfer by the Corporation of all or substantially all of its property, or any reduction by at least seventy percent (70%) of the then issued and outstanding Common Shares of the Corporation, shall be deemed to be a liquidation of the Corporation within the meaning of any of the provisions of this Part 2.

2.2 Subject to the provisions of Part 6 hereof, all amounts to be paid as preferential distributions to the holders of Series I Class A Preferred Stock, as provided in this Part 2, shall be paid or set apart for payment before the payment or setting apart for payment of any amount for, or the distribution of any of the Corporation’s property to the holders of Common Shares, whether now or hereafter authorized, in connection with such liquidation, dissolution or winding up.

Part 3 - Dividends.

3.1 Holders of record of Series I Class A Preferred Stock, out of funds legally available therefor and to the extent permitted by law, shall be entitled to receive dividends on their Series I Class A Preferred Stock, which dividends shall accrue at the rate per share of five percent (5%) per annum of consideration paid for each share of Series I Class A Preferred Stock ($50.00 per share per year for each full year) commencing on the date of the issuance thereof, payable, at the option of the Corporation, (i) in cash, or (ii) by the issuance of that number of whole Common Shares computed by dividing the amount of the dividend by the market price applicable to such dividend.

3.2 For the purposes of this Part 3 and Part 4 hereof, “market price” means the average of the daily closing prices of Common Shares for a period of five (5) consecutive trading days ending on the date on which any dividend becomes payable or of any notice of redemption as the case may be. The closing price for each trading day shall be (i) for any period during which the Common Shares shall be listed for trading on a national securities exchange, the last reported bid price per share of Common Shares as reported by the primary stock exchange, or the Nasdaq Stock Market, if the Common Shares are quoted on the Nasdaq Stock Market, or (ii) If last sales price information is not available, the average closing bid price of Common Shares as reported by the Nasdaq Stock Market, or if not so listed or reported, then as reported by National Quotation Bureau, Incorporated, or (iii) in the event neither clause (i) nor (ii) is applicable, the average of the closing bid and asked prices as furnished by any member of the National Association of Securities Dealers, Inc., selected from time to time by the Corporation for that purpose.

3.3 Dividends on Series I Class A Preferred Stock shall be cumulative, and no dividends or other distributions shall be paid or declared and set aside for payment on the Common Shares until full cumulative dividends on all outstanding Series I Class A Preferred Stock shall have been paid or declared and set aside for payment.

3.4 Dividends shall be payable in arrears, at the rate of $12.50 per share for each full calendar quarter on each February 28, May31, August 31, and November 30 of each calendar year, to the holders of record of the Series I Class A Preferred Stock as they appear in the securities register of the Corporation on such record dates not more than sixty (60) nor less than ten (10) days preceding the payment date thereof, as shall be fixed by the Board; provided, however, that the initial dividend for the Series I Class A Preferred Stock shall accrue for the period commencing on the date of the issuance thereof to and including December 31, 1995.

3.5 If, in any quarter, insufficient funds are available to pay such dividends as are then due and payable with respect to the Series I Class A Preferred Stock and all other classes and series of the capital stock of the Corporation ranking in parity therewith (or such payment is otherwise prohibited by provisions of the GCL, such funds as are legally available to pay such dividends shall be paid or Common Shares will be issued as stock dividends to the holders of Series I Class A Preferred Stock and to the holders of any other series of Class A Preferred Stock then outstanding as provided in Part 6 hereof, in accordance with the rights of each such holder, and the balance of accrued but undeclared and/or unpaid dividends, if any shall be declared and paid on the next succeeding dividend date to the extent that funds are then legally available for such purpose.

Part 4 - Redemption.

4.1 At any time, and from time to time, on and after one hundred twenty (120) days from the date of the issuance of any Series I Class A Preferred Stock, if the average of the closing bid prices for the Common Shares for five (5) consecutive trading days shall be in excess of $1.50, the Corporation may, at its sole option, but shall not be obligated to, redeem, in whole or in part, the then outstanding Series I Class A Preferred Stock at a price per share of U. S. $1,000 each (the “Redemption Price”) (such price to be adjusted proportionately in the event of any change of the Series I Class A Shares into a different number of Shares).

4.2 Thirty (30) days prior to any date stipulated by the Corporation for the redemption of Series I Class A Preferred Stock (the “Redemption Date”), written notice (the “Redemption Notice”) shall be mailed to each holder of record on such notice date of the Series I Class A Preferred Stock. The Redemption Notice shall state: (i) the Redemption Date of such Shares, (ii) the number of Series I Class A Preferred Stock to be redeemed from the holder to whom the Redemption Notice is addressed, (iii) instructions for surrender to the Corporation, in the manner and at the place designated of a share certificate or share certificates representing the number of Series I Class A Preferred Stock to be redeemed from such holder, and (iv) instructions as to how to specify to the Corporation the number of Series I Class A Preferred Stock to be redeemed as provided in this Part 4, and the number of shares to be convened into Common Shares as provided in Part 5 hereof.

4.3 Upon receipt of the Redemption Notice, any Eligible Holder (as defined in Section 5.2 hereof) shall have the option, at its Sole election, to specify what portion of its Series I Class A Preferred Stock called for redemption in the Redemption Notice shall be redeemed as provided in this Part 4 or convened into Common Shares in the manner provided in Part 5 hereof, except that, notwithstanding any provision of such Part 5 to the contrary, any Eligible Holder shall have the right to convert into Common Shares that number of Series I Class A Preferred Stock called for redemption in the Redemption Notice.

4.4 On or before the Redemption Date in respect of any Series I Class A Preferred Stock, each holder of such shares shall surrender the required certificate or certificates representing such shares to the Corporation in the manner and at the place designated in the Redemption Notice, and upon the Redemption Date, the Redemption Price for such shares shall be made payable, in the manner provided in Section 5.5 hereof, to the order of the person whose name appears on such certificate or certificates as the owner thereof, and each surrendered share certificate shall be canceled and retired. If a share certificate is surrendered and all the shares evidenced thereby are not being redeemed (as described below), the Corporation shall cause the Series I Class A Shares which are not being redeemed to be registered in the names of the persons whose names appear as the owners on the respective surrendered share certificates and deliver such certificate to such person.

4.5 On the Redemption Date in respect of any Series I Class A Shares or prior thereto, the Corporation shall deposit with any bank or trust company having a capital and surplus of at least U.S. $50,000,000, as a trust fund, a sum equal to the aggregate Redemption Price of all such shares called from redemption (less the aggregate Redemption Price for those Series I Class A Shares in respect of which the Corporation has received notice from the Eligible Holder thereof of its election to convert Series I Class A Shares in to Common Shares), with irrevocable instructions and authority to the bank or trust company to pay, on or after the Redemption Date, the Redemption Price to the respective holders upon the surrender of their share certificates. The deposit shall constitute full payment for the shares to their holders, and from and after the date of the deposit the redeemed share shall be deemed to be no longer outstanding, and holders thereof shall cease to be shareholders with respect to such shares and shall have no rights with respect thereto except the rights to receive from the bank or trust company payments of the Redemption price of the shares, without interest, upon surrender of their certificates thereof. Any funds so deposited and unclaimed at the end of one year following the Redemption Date shall be released or repaid to the Corporation, after which the former holders of shares called for redemption shall be entitled to receive payment of the Redemption Price in respect of their shares only from the Corporation.

Part 5 - Conversion.

5.1 For the purposes of conversion of the Series I Class A Preferred Stock shall be valued at $1,000 per share (“Value”), and, if converted, the Series I Class A Preferred Stock shall be converted into such number of Common Shares (the “Conversion Shares”) as is obtained by dividing the aggregate Value of the shares of Series I Class A Preferred Stock being so converted, together with all accrued but unpaid dividends thereon, by the “Average Stock Price” per share of the Conversion Shares (the “Conversion Price”), subject to adjustment pursuant to the provisions of this Part 5. For purposes of this Part 5, the “Average Stock Price” means the lesser of (x) seventy percent (70%) of the average daily closing bid prices of the Common Shares for the period of five (5) consecutive trading days immediately preceding the date of subscription by the Holder or (y) seventy percent (70%) of the daily average closing bid prices of Common Shares for the period of five (5) consecutive trading days immediately preceding the date of the conversion of the Series I Class A Preferred Stock in respect of which such Average Stock Price is determined. The closing price for each trading day shall be determined as provided in the last sentence of Section 3.2.

5.2 Any holder of Series I Class A Preferred Stock (an “Eligible Holder”) may at any time commencing forty-five (45) days after the issuance of any Series I Class A Preferred Stock convert up to one hundred percent (100%) of his holdings of Series I Class A Preferred Stock in accordance with this Part 5.

5.3 The conversion right granted by Section 5.2 hereof may be exercised only by an Eligible Holder of Series I Class A Preferred Stock, in whole or in part, by the surrender of the share certificate or share certificates representing the Series I Class A Preferred Stock to be converted at the principal office of the Corporation (or at such other place as the Corporation may designate in a written notice sent to the holder by first class mail, postage prepaid, at its address shown on the books of the Corporation) against delivery of that number of whole Common Shares as shall be computed by dividing (I) the aggregate Value of the Series I Class A Preferred Stock so surrendered for conversion plus any accrued but unpaid dividends thereon, if any, by (2) the Conversion Price in effect at the date of the conversion. At the time of conversion of a share of the Series I Class A Preferred Stock, the Corporation shall pay in cash to the holder thereof an amount equal to all unpaid dividends, if any, accrued thereon to the date of conversion, or at the Corporation’s option, issue that number of whole Common Shares which is equal to the product of dividing the amount of such unpaid dividends by the Average Stock Price whether or not declared by the Board. Each Series I Class A Preferred Stock share certificate surrendered for conversion shall be endorsed by its holder. In the event of any exercise of the conversion right of the Series I Class A Preferred Stock granted herein (i) share certificate representing the Common Shares purchased by virtue of such exercise shall be delivered to such holder within three (3) days of notice of conversion, and (ii) unless the Series I Class A Preferred Stock has been fully converted, anew share certificate representing the Series I Class A Preferred Stock not so converted, if any, shall also be delivered to such holder within three (3) days of notice of conversion. Any Eligible Holder may exercise its right to convert the Series I Class A Preferred Stock by telecopying an executed and completed Notice of Conversion to the Corporation, and within seventy-two (72) hours thereafter, delivering the original Notice of Conversion and the certificate representing the Series I Class A Preferred Stock to the Corporation by express courier. Each date on which a Notice of Conversion is telecopied to and received by the Corporation in accordance with the provisions hereof shall be deemed a conversion date. The Corporation will transmit the Common Shares certificates issuable upon conversion of any Series I Class A Preferred Stock (together with the certificates representing the Series I Class A Preferred Stock not so converted) to the Eligible Holder via express courier within three (3) business days after the conversion date if the Corporation has received the original Notice of Conversion and the Series I Class A Shares certificates being so converted by such date.

5.4 All Common Shares which may be issued upon conversion of Series I Class A Preferred Stock will, upon issuance, be duly issued, fully paid and nonassessable and free from all taxes, liens, and charges with respect to the issue thereof. At all times that any Series I Class A Preferred Stock is outstanding, the Corporation shall have authorized, and shall have reserved for the purpose of issuance upon such conversion, a sufficient number of Common Shares to provide for the conversion into Common Shares of all Series I Class A Preferred Stock then outstanding at the then effective Conversion Price. Without limiting the generality of the foregoing, if, at any time, the Conversion Price is decreased, the number of Common Shares authorized and reserved for issuance upon the conversion of the Series I Class A Preferred Stock shall be proportionately increased.

5.5 The number of Common Shares issued upon conversion of Series I Class A Preferred Stock and the Conversion Price shall be subject to adjustment from time to time upon the happening of certain events, as follows:

5.5.1 Change of Designation of the Common Shares or the rights, privileges, restrictions and conditions in respect of the Common Shares or division of the Common Shares into series. In the case of any amendment to the Articles to change the designation of the Common Shares or the rights, privileges, restrictions or conditions in respect of the Common Shares or division of the Common Shares into series the rights of the holders of the Series I Class A Preferred Stock shall be adjusted so as to provide that upon conversion thereof, the holder of the Series I Class A Preferred Stock being converted shall procure, in lieu of each Common Share theretofore issuable upon such conversion, the kind and amount of shares, other securities, money and property receivable upon such designation, change or division by the holder of one Common Share issuable upon such conversion had conversion occurred immediately prior to such designation, change or division. The Series I Class A Preferred Stock shall be deemed thereafter to provide for adjustments which shall be as nearly equivalent as may be practicable to the adjustments provided for in this Part 5. The provisions of this subsection 5.5.1 shall apply in the same manner to successive reclassifications, changes, consolidations, and mergers.

5.5.2 If the Corporation, at any time while any of the Series I Class A Preferred Stock is outstanding, shall amend the Articles so as to change the Common Shares into a different number of shares, the Conversion Price shall be proportionately reduced, in case of such change increasing the number of Common Shares, as of the effective date of such increase, or if the Corporation shall take a record of holders of its Common Shares for the purpose of such increase, as of such record date, whichever is earlier, or the Conversion Price shall be proportionately increased, in the case of such change decreasing the number of Common Shares, as of the effective date of such decrease or, if the Corporation shall take a record of holders of its Common Stock for the purpose of such decrease, as of such record date, whichever is earlier.

5.5 3 If the Corporation, at any time while any of the Series I Class A Preferred Stock is outstanding, shall pay a dividend payable in Common Shares (except for any dividends of Common Shares payable pursuant to Part 3 hereof), the Conversion Price shall be adjusted, as of the date the Corporation shall take a record of the holders of its Common Shares for the purposes of receiving such dividend (or if no such record is taken, as of the date of payment of such dividend), to that price determined by multiplying the Conversion Price therefor in effect by a fraction (1) the numerator of which shall be the total number of Common Shares outstanding immediately prior to such dividend, and (2) the denominator of which shall be the total number of Common Shares outstanding immediately after such dividend (plus in the event that the Corporation paid cash for fractional shares, the number of additional shares which would have been outstanding had the Corporation issued fractional shares in connection with said dividend).

5.6 Whenever the Conversion Price shall be adjusted pursuant to Section 5.5 hereof, the Corporation shall make a certificate signed by its President, or a Vice President and by its Treasurer, Assistant Treasurer, Secretary or Assistant Secretary, setting forth, in reasonable detail, the event requiring the adjustment, the amount of the adjustment, the method by which such adjustment was calculated (including a description of the basis on which the Board of Directors made any determination hereunder), and the Conversion Price after giving effect to such adjustment, and shall cause copies of such certificates to be mailed (by first class mail, postage prepaid) to each holder of the Series I Class A Preferred Stock at its address shown on the books of the Corporation. The Corporation shall make such certificate and mail it to each such holder promptly after each adjustment.

5.7 No fractional Common Shares shall be issued in connection with any conversion of Series I Class A Preferred Stock, but in lieu of such fractional shares, the Corporation shall make a cash payment therefor equal in amount to the product of the applicable fraction multiplied by the Conversion Price then in effect.

5.8 No Series I Class A Preferred Stock which has been converted into Common Shares shall be reissued by the Corporation; provided, however, that each such share shall be restored to the status of authorized but unissued Preferred Stock without designation as to series and may thereafter be issued as a series of Preferred Stock not designated as Series I Class A Preferred Stock.

Part 6 - parity with Other Shares of Class A Preferred Shares.

6.1 If any cumulative dividends or accounts payable or return of capital in respect of Series I Class A Preferred Stock are not paid in full, the owners of all series of outstanding Preferred Stock shall participate rateably in respect of accumulated dividends and return of capital.

Part 7 - Amendment.

7.1 In addition to any requirement for a series vote pursuant to the GCL in respect of any amendment to the Corporation’s Certificate of Incorporation that adversely affects the rights, privileges, restrictions and conditions of the Series I Class A Preferred Stock, the rights, privileges, restrictions and conditions attaching to the Series I Class A Preferred Stock: may be amended by an amendment to the Corporation’s Certificate of Incorporation so as to affect such adversely only if the Corporation has obtained the affirmative vote at a duly called and held series meeting of the holders of the Series I Class A Preferred Stock or written consent by the holders of a majority of the Series I Class A Preferred Stock then outstanding. Notwithstanding the above, the number of authorized shares of such class or classes of stock may be increased or decreased (but not below the number of shares thereof outstanding) by the affirmative vote of the holders of a majority of the stock of the Corporation entitled to vote thereon, voting as a single class, irrespective of this Section 7.1.

CERTIFICATE OF DESIGNATIONS

OF SERIES 2 CLASS B CONVERTIBLE PREFERRED STOCK

OF

PERMA-FIX ENVIRONMENTAL SERVICES, INC.

Perma-Fix Environmental Services Inc. (the “Corporation”), a corporation organized and existing under the General Corporation Law of the State of Delaware, does hereby certify:

That, pursuant to authority conferred upon by the Board of Directors by the Corporation’s Restated Certificate of Incorporation, as amended. And pursuant to the provisions of Section151of the Delaware Corporation Law, the Board of Directors of the Corporation has adopted resolutions, a copy of which is attached hereto, establishing and providing for the issuance of a series of Preferred Stock designated as Series 2 Class B Convertible Preferred Stock and has established and fixed the voting powers, designations, preferences and relative participating, optional and other special rights and qualifications, limitations and restrictions of such Series 2 Class B Convertible Preferred Stock as set forth in the attached resolutions.

| Dated: February 16, 1996 |

PERMA-FIX ENVIRONMENTAL SERVICES, INC. |

|

| |

|

|

|

|

|

By

|

|

|

| |

|

Dr. Louis F. Centofanti

Chairman of the Board

|

|

| |

|

|

|

ATTEST:

|

|

| Mark A. Zwecker. Secretary |

|

PERMA-FIX ENVIRONMENTAL SERVICES, INC.

(the “Corporation”)

RESOLUTION OF THE BOARD OF DIRECTORS

FIXING THE NUMBER AND DESIGNATING THE RIGHTS, PRIVILEGES,

RESTRICTIONS AND CONDITIONS ATTACHING TO THE

SERIES 2 CLASS B CONVERTIBLE PREFERRED STOCK

WHEREAS,

A. The Corporation’s share capital includes Preferred Stock, par value $.001 per share (“Preferred Stock”), which Preferred Stock may be issued in one or more series with the directors of the Corporation (the “Board”) being entitled by resolution to fix the number of shares in each series and to designate the rights, designations, preferences, and relative, participating, optional or other special rights, privileges, restrictions and conditions attaching to the shares of each such series; and

B. It is in the best interests of the Corporation for the Board to create a new series from the Preferred Stock designated as the Series 2 Class B Convertible Preferred Stock, par value $.001.

NOW, THEREFORE, BE IT RESOLVED, THAT:

The Series 2 Class B Convertible Preferred Stock, par value $.001 (the “Series 2 Class B Preferred Stock”) of the Corporation shall consist of 2,500 shares and no more and shall be designated as the Series 2 Class B Preferred Stock and in addition to the preferences, rights, privileges, restrictions and conditions attaching to all the Series 2 Class B Preferred Stock as a series, the rights, privileges, restrictions and conditions attaching to the Series Z Class B Preferred Stock shall be as follows:

Part 1 - Voting and Preemptive Rights.

1.1 Except as otherwise provided herein, in the Corporation’s Certificate of Incorporation (the “Articles”) or the General Corporation Law of the State of Delaware (the “GCL”), each holder of Series 2 Class B Preferred Stock, by virtue of his ownership thereof, shall be entitled to cast that number of votes per share thereof on each matter submitted to the Corporation’s shareholders for voting which equals the number of votes which could be cast by such holder of the number of shares of the Corporation’s Common Stock, par value $.001 per share (the “Common Shares”) into which such shares of Series 2 Class B Preferred Stock would be entitled to be converted into pursuant to Part 5 hereof on the record date of such vote. The outstanding Series 2 Class B Preferred Stock, the Common Shares of the Corporation and any other series of Preferred Stock of the Corporation having, voting rights shall vote together as a single class, except as otherwise expressly required by the GCL or Part 7 hereof. The Series 2 Class B Preferred Stock shall not have cumulative voting rights.

1.2 The Series 2 Class B Preferred Stock shall not give its holders any preemptive rights to acquire any other securities issued by the Corporation at any time in the future.

Part 2 - Liquidation Rights.

2.1 If the Corporation shall be voluntarily or involuntarily liquidated, dissolved or wound up at any time when any Series 2 Class B Preferred Stock shall be outstanding, the holders of the then outstanding Series 2 Class B Preferred Stock shall have a preference in distribution of the Corporation’s property available for distribution to the holders of the Common Shares equal to $1.000 consideration per outstanding share of Series 2 Class B Preferred Stock, together with an amount equal to all unpaid dividends accrued thereon, if any, to the date of payment of such distribution, whether or not declared by the Board; provided, however, that the merger of the Corporation with any corporation or corporations in which the Corporation is not the survivor, or the safe or transfer by the Corporation of all or substantially all of its property, or a reduction by at least seventy percent (70%) of the then issued and outstanding Common Shares of the Corporation, shall be deemed to be a liquidation of the Corporation within the meaning of any of the provisions of this Part 2.

2.2 Subject to the provisions of Part 6 hereof, all amounts to be paid as preferential distributions to the holders of Series 2 Class B Preferred Stock, as provided in this Part 2, shall be paid or set apart for payment before the payment or setting apart for payment of any amount for, or the distribution of any of the Corporation’s property to the holders of Common Shares, whether now or hereafter authorized, in connection with such liquidation, dissolution or winding up.

2.3 After the payment to the holders of the shares of the Series 2 Class B Preferred Stock of the full preferential amounts provided for in this Part 2, the holders of the Series 2 Class B Preferred Stock as such shall have no right or claim to any of the remaining assets of the Corporation.

2.4 In the event that the assets of the Corporation available for distribution to the holders of shares of the Series 2 Class B Preferred Stock upon any dissolution, liquidation or winding up of the Corporation, whether voluntary or involuntary, shall be insufficient to pay in full all amounts to which such holders are entitled pursuant to this Part 2, no such distribution shall be made on account of any shares of any other class or series of Preferred Stock ranking on a parity with the shares of this Series 2 Class B Preferred Stock upon such dissolution, liquidation or winding up unless proportionate distributive amounts shall be paid on account of the shares of this Series 2 Class B Preferred Stock and shares of such other class or series ranking on a parity with the shares of this Series 2 Class B Preferred Stock, ratably, in proportion to the full distributable amounts for which holders of all such parity shares are respectively entitled upon such dissolution, liquidation or winding up.

Part 3 - Dividends.

3.1 Holders of record of Series 2 Class B Preferred Stock, out of funds legally available therefor and to the extent permitted by law, shall be entitled to receive dividends on their Series 2 Class B Preferred Stock, which dividends shall accrue at the rate per share of five percent (5%) per annum of consideration paid for each share of Series 2 Class B Preferred Stock ($50.00 per share per year for each full year) commencing on the date of the issuance thereof, payable, at the option of the Corporation, (i) in cash, or (ii) by the issuance of that number of whole Common Shares computed by dividing the amount of the dividend by the market price applicable to such dividend.

3.2 For the purposes of this Part 3 and Part 4 hereof, “market price” means the average of the daily closing prices of Common Shares for a period of five (5) consecutive trading days ending on the date on which any dividend becomes payable or of any notice of redemption as the case may be. The closing price for each trading day shall be (i) for any period during which the Common Shares shall be listed for trading on a national securities exchange, the last reported bid price per share of Common Shares as reported by the primary stock exchange, or the Nasdaq Stock Market, if the Common Shares are quoted on the Nasdaq Stock Market, or (ii) if last sales price information is not available, the average closing bid price of Common Shares as reported by the Nasdaq Stock Market, or if not so listed or reported, then as reported by National Quotation Bureau, Incorporated, or (iii) in the event neither clause (i) nor (ii) is applicable, the average of the Closing bid and asked prices as furnished by any member of the National Association of Securities Dealers, Inc., selected from time to time by the Corporation for that purpose.

3.3 Dividends on Series 2 Class B Preferred Stock shall be cumulative, and no dividends or other distributions shall be paid or declared and set aside for payment on the Common Shares until full cumulative dividends on all outstanding Series 2 Class B Preferred Stock shall have been paid or declared and set aside for payment.

3.4 Dividends shall be payable in arrears, at the rate of $12.50 per share for each full calendar quarter on each February 28, May 31, August 31, and November 30 of each calendar year, to the holders of record of the Series 2 Class B Preferred Stock as they appear in the securities register of the Corporation on such record dates not more than sixty (60) nor less than ten (10) days preceding the payment date thereof, as shall be fixed by the Board; provided, however, that the initial dividend for the Series 2 Class B Preferred Stock shall accrue for the period commencing on the date of the issuance thereof.

3.5 If, in any quarter, insufficient funds are available to pay such dividends as are then due and payable with respect to the Series 2 Class B Preferred Stock and all other classes and series of the capital stock of the Corporation ranking in parity therewith (or such payment is otherwise prohibited by provisions of the GCL, such funds as are legally available to pay such dividends shall be paid or Common Shares will be issued as stock dividends to the holders of Series 2 Class B Preferred Stock and to the holders of any other series of Class B Preferred Stock then outstanding as provided in Pact 6 hereof, in accordance with the rights of each such holder, and the balance of accrued but undeclared and/or unpaid dividends, if any. shall be declared and paid on the next succeeding dividend date to the extent that funds are then legally available for such purpose.

Part 4 - Redemption.

4.1 At any time, and from time to time, on and after one hundred twenty (120) days from the date of the issuance of any Series 2 Class B Preferred Stock, if the average of the closing bid prices for the Common Shares for five (5) consecutive trading days shall be in excess of $1.50 per share, the Corporation may, at its sole option, but shall not be obligated to, redeem, in whole or in part, the then outstanding Series 2 Class B Preferred Stock at a price per share of U. S. $1.000 each (the “Redemption Price”) (such price to be adjusted proportionately in the event of any change of the Series 2 Class B Preferred Stock into a different number of shares of Series 2 Class B Preferred Stock).

4.2 Thirty (30) days prior to any date stipulated by the Corporation for the redemption of Series 2 Class B Preferred Stock (the “Redemption Date”), written notice (the “Redemption Notice”) shall be mailed to each holder of record on such notice date of the Series 2 Class B Preferred Stock. The Redemption Notice Shall state: (i) the Redemption Date of such shares, (ii) the number of Series 2 Class B Preferred Stock to be redeemed from the holder to whom the Redemption Notice is addressed, (iii) instructions for surrender to the Corporation, in the manner and at the place designated of a share certificate or share certificates representing the number of Series 2 Class B Preferred Stock to be redeemed from such holder, and (iv) instructions as to how to specify to the Corporation the number of Series 2 Class B Preferred Stock to be redeemed as provided in this Part 4, and the number of shares to be converted into Common Shares as provided in Part 5 hereof.

4.3 Upon receipt of the Redemption Notice, any Eligible Holder (as defined in Section 5.2 hereof) shall have the option, at its sole election, to specify what portion of its Series 2 Class B Preferred Stock called for redemption in the Redemption Notice shall be redeemed as provided in this Part 4 or converted into Common Shares in the manner provided in Part 5 hereof, except that, notwithstanding any provision of such Part 5 to the contrary, any Eligible Holder shall have the right to convert into Common Shares that number of Series 2 Class B Preferred Stock called for redemption in the Redemption Notice.

4.4 On or before the Redemption Date in respect of any Series 2 Class B Preferred Stock, each holder of such shares shall surrender the required certificate or certificates representing such shares to the Corporation in the manner and at the place designated in the Redemption Notice, and upon the Redemption Date, the Redemption Price for such shares shall be made payable, in the manner provided in Section 4.5 hereof, to the order of the person whose name appears on such certificate or certificates as the owner thereof, and each surrendered share certificate shall be canceled and retired. If a share certificate is surrendered and all the shares evidenced thereby are not being redeemed (as described below), the Corporation shall cause the Series 2 Class B Preferred Stock which are not being redeemed to be registered in the names of the persons whose names appear as the owners on the respective surrendered share certificates and deliver such certificate to such person.

4.5 On the Redemption Date in respect of any Series 2 Class B Preferred Stock or prior thereto, the Corporation shall deposit with any bank or trust company having a capital and surplus of at least U. S. $50,000,000, as a trust fund, a sum equal to the aggregate Redemption Price of all such shares called from redemption (less the aggregate Redemption Price for those Series 2 Class B Preferred Stock in respect of which the Corporation has received notice from the Eligible Holder thereof of its election to convert Series 2 Class B Preferred Stock in to Common Shares), with irrevocable instructions and authority to the bank or trust company to pay, on or after the Redemption Date, the Redemption Price to the respective holders upon the surrender of their share certificates. The deposit shall constitute full payment for the shares to their holders, and from and after the date of the deposit the redeemed share shall be deemed to be no longer outstanding, and holders thereof shall cease to be shareholders with respect to such shares and shall have no rights with respect thereto except the rights to receive from the bank or trust company payments of the Redemption price of the shares, without interest, upon surrender of their certificates thereof. Any funds so deposited and unclaimed at the end of one year following the Redemption Date shall be released or repaid to the Corporation, after which the former holders of shares called for redemption shall be entitled to receive payment of the Redemption Price in respect of their shares only from the Corporation.

Part 5 - Conversion.

5.1 For the purposes of conversion of the Series 2 Class B Preferred Stock shall be valued at $1,000 per share (“Value”), and, if converted, the Series 2 Class B Preferred Stock shall be converted into such number of Common Shares (the “Conversion Shares”) as is obtained by dividing the aggregate Value of the shares of Series 2 Class B Preferred Stock being so converted, together with all accrued but unpaid dividends thereon, by the “Average Stock Price” per share of the Conversion Shares (the “Conversion Price”), subject to adjustment pursuant to the provisions of this Part 5. For purposes of this Part 5, the “Average Stock Price” means the lesser of (x) seventy percent (70%) of the average daily closing bid prices of the Common Shares for a period of five (5) consecutive trading days immediately preceding the date of subscription by the Holder or (y) seventy percent (70%) of the average daily closing bid prices of Common Shares for the period of five (5) consecutive trading days immediately preceding the date of the conversion of the Series 2 Class B Preferred Stock in respect of which such Average Stock Price is determined. The closing price for each trading day shall be determined as provided in the last sentence of Section 3.2.

5.2 Any holder of Series 2 Class B Preferred Stock (an “Eligible Holder”) may at any time commencing forty-five (45) days after the issuance of any Series 2 Class B Preferred Stock convert up to one hundred percent (100%) of his holdings of Series 2 Class B Preferred Stock in accordance with this Part 5.

5.3 The conversion right granted by Section 5.2 hereof may be exercised only by an Eligible Holder of Series 2 Class B Preferred Stock, in whole or in part, by the surrender of the share certificate or share certificates representing the Series 2 Class B Preferred Stock to be converted at the principal office of the Corporation (or at such other place as the Corporation may designate in a written notice sent to the holder by first class mail, postage prepaid, at its address shown on the books of the Corporation) against delivery of that number of whole Common Shares as shall be computed by dividing (1) the aggregate Value of the Series 2 Class B Preferred Stock so surrendered for conversion plus any accrued but unpaid dividends thereon, if any, by (2) the Conversion Price in effect at the date of the conversion. At the time of conversion of a share of the Series 2 Class B Preferred Stock, the Corporation shall pay in cash to the holder thereof an amount equal to all unpaid dividends, if any, accrued thereon to the date of conversion, or, at the Corporation’s option, issue that number of whole Common Shares which is equal to the product of dividing the amount of such unpaid dividends by the Average Stock Price whether or not declared by the Board. Each Series 2 Class B Preferred Stock share certificate surrendered for conversion shall be endorsed by its holder. In the event of any exercise of the conversion right of the Series 2 Class B Preferred Stock granted herein (i) share certificate representing the Common Shares purchased by virtue of such exercise shall be delivered to such holder within three (3) days of notice of conversion, and (ii) unless the Series 2 Class B Preferred Stock has been fully converted, a new share certificate representing the Series 2 Class B Preferred Stock not so converted, if any, shall also be delivered to such holder within three (3) days of notice of conversion. Any Eligible Holder may exercise its right to convert the Series 2 Class B Preferred Stock by telecopying an executed and completed Notice of Conversion to the Corporation, and within seventy-two (72) hours thereafter, delivering the original Notice of Conversion and the certificate representing the Series 2 Class B Preferred Stock to the Corporation by express courier. Each date on which a Notice of Conversion is telecopied to and received by the Corporation in accordance with the provisions hereof shall be deemed a conversion date. The Corporation will transmit the Common Shares certificates issuable upon conversion of any Series 2 Class B Preferred Stock (together with the certificates representing the Series 2 Class B Preferred Stock not so converted) to the Eligible Holder via express courier within three (3) business days after the conversion date if the Corporation has received the original Notice of Conversion and the Series 2 Class B Shares certificates being so converted by such date.

5.4 All Common Shares which may be issued upon conversion of Series 2 Class B Preferred Stock will, upon issuance, be duly issued, fully paid and nonassessable and free from all taxes, liens, and charges with respect to the issue thereof. At all times that any Series 2 Class B Preferred Stock is outstanding, the Corporation shall have authorized, and shall have reserved for the purpose of issuance upon such conversion, a sufficient number of Common Shares to provide for the conversion into Common Shares of all Series 2 Class B Preferred Stock then outstanding at the then effective Conversion Price. Without limiting the generality of the foregoing, if, at any time, the Conversion Price is decreased, the number of Common Shares authorized and reserved for issuance upon the conversion of the Series 2 Class B Preferred Stock shall be proportionately increased.

5.5 The number of Common Shares issued upon conversion of Series 2 Class B Preferred Stock and the Conversion Price shall be subject to adjustment from time to time upon the happening of certain events, as follows;

5.5.1 In the case of any amendment to the Articles to change the designation of the Common Shares or the rights, privileges, restrictions or conditions in respect of the Common Shares or division of the Common Shares into series the rights of the holders of the Series 2 Class B Preferred Stock shall be adjusted so as to provide that upon conversion thereof, the holder of the Series 2 Class B Preferred Stock being converted shall procure, in lieu of each Common Share theretofore issuable upon such conversion, the kind and amount of shares, other securities, money and property receivable upon such designation, change or division by the holder of one Common Share issuable upon such conversion had conversion occurred immediately prior to such designation, change or division. The Series 2 Class B Preferred Stock shall be deemed thereafter to provide for adjustments which shall be as nearly equivalent as may be practicable to the adjustments provided for in this Part 5. The provisions of this subsection 5.5.1 shall apply in the same manner to successive reclassifications, changes, consolidations, and mergers.

5.5.2 If the Corporation, at any time while any of the Series 2 Class B Preferred Stock is outstanding, shall amend the Articles so as to change the Common Shares into a different number of shares, the Conversion Price shall be proportionately reduced, in ease of such change increasing the number of Common Shares, as of the effective date of such increase, or if the Corporation shall take a record of holders of its Common Shares for the purpose of such increase, as of such record date, whichever is earlier, or the Conversion Price shall be proportionately increased, in the case of such change decreasing the number of Common Shares, as of the effective date of such decrease or, if the Corporation shall take a record of holders of its Common Stock for the purpose of such decrease, as of such record date, whichever is earlier.

5.5.3 If the Corporation, at any time while any of the Series 2 Class B Preferred Stock is outstanding, shall pay a dividend payable in Common Shares (except for any dividends of Common Shares payable pursuant to Part 3 hereof), the Conversion Price shall be adjusted, as of the date the Corporation shall take a record of the holders of its Common Shares for the purposes of receiving such dividend (or if no such record is taken, as of the date of payment of such dividend), to that price determined by multiplying the Conversion Price therefor in effect by a fraction (1) the numerator of which shall be the total number of Common Shares outstanding immediately prior to such dividend, and (2) the denominator of which shall be the total number of Common Shares outstanding immediately after such dividend (plus in the event that the Corporation paid cash for fractional shares, the number of additional shares which would have been outstanding had the Corporation issued fractional shares in connection with said dividend).

5.6 Whenever the Conversion Price shall be adjusted pursuant to Section 5.5 hereof, the Corporation shall make a certificate signed by its President, or a Vice President and by its Treasurer, Assistant Treasurer, Secretary or Assistant Secretary, setting forth, in reasonable detail, the event requiring the adjustment, the amount of the adjustment, the method by which such adjustment was calculated (including a description of the basis on which the Board of Directors made any determination hereunder), and the Conversion Price after giving effect to such adjustment, and shall cause copies of such certificates to be mailed (by first class mail, postage prepaid) to each holder of the Series 2 Class B Preferred Stock at its address shown on the books of the Corporation. The Corporation shall make such certificate and mail it to each such holder promptly after each adjustment.

5.7 No fractional Common Shares shall be issued in connection with any conversion of Series 2 Class B Preferred Stock, but in lieu of such fractional shares, the Corporation shall make a cash payment therefor equal in amount to the product of the applicable fraction multiplied by the Conversion Price then in effect.

5.8 No Series 2 Class B Preferred Stock which has been converted into Common Shares shall be reissued by the Corporation; provided, however, that each such share shall be restored to the status of authorized but unissued Preferred Stock without designation as to series and may thereafter be issued as a series of Preferred Stock not designated as Series 2 Class B Preferred Stock.

Part 6 - Parity with Other Shares of Series 2 Class B Preferred Stock and Priority.

6.1 If any cumulative dividends or accounts payable or return of capital in respect of Series 2 Class B Preferred Stock are not paid in full, the owners of all series of outstanding Preferred Stock shall participate rateably in respect of accumulated dividends and return of capital.

6.2 For purposes of this resolution, any stock of any class or series of the Corporation shall be deemed to rank:

6.2.1 Prior or senior to the shares of this Series 2 Class B Preferred Stock either as to dividends of upon liquidation, if the holders of such class or classes shall be entitled to the receipt of dividends or of amounts distributable upon dissolution, liquidation or winding up of the Corporation. whether voluntary or involuntary, as the case may be, in preference or priority to the holders of shares of this Series 2 Class B Preferred Stock;